Payroll tax calculator 2023

Time and attendance software with project tracking to help you be more efficient. Use the Free Paycheck Calculators for any gross-to-net calculation need.

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

The annual threshold is adjusted if you are not an employer for a.

. Ad No more forgotten entries inaccurate payroll or broken hearts. Free Unbiased Reviews Top Picks. Get Started With ADP Payroll.

As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022-2023. Ad Process Payroll Faster Easier With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll.

Our Expertise Helps You Make a Difference. Ad The Best HR Payroll Partner For Medium and Small Businesses. Thats where our paycheck calculator comes in.

The maximum an employee will pay in 2022 is 911400. 2022 Federal income tax withholding calculation. Well calculate the difference on what you owe and what youve paid.

Ad Compare This Years Top 5 Free Payroll Software. Free SARS Income Tax Calculator 2023 TaxTim SA. Get Started With ADP Payroll.

Paycors Tech Saves Time. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. As earnings rise each dollar of earnings above the previous level is taxed at a higher rate.

Incomes from 30000 to 6000 are taxed at 482. If youve already paid more than what you will owe in taxes youll likely receive a refund. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Prepare and e-File your. Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. Subtract 12900 for Married otherwise.

Click here to see why you still need to file to get your Tax Refund. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Time and attendance software with project tracking to help you be more efficient.

State Disability Tax provides temporary funding for non-work related disabilities as well as paid family leave for those caring for an ill family member or bonding with their. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an. See where that hard-earned money goes - with UK.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Its so easy to. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

How to calculate annual income. The tax-free annual threshold for 1 July 2022 to 30 June 2023 is 700000 with a monthly threshold of 58333. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

The standard FUTA tax rate is 6 so your max. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to.

Take a Guided Tour. The highest tax bracket is 6 while those making less than that are taxed at 44. The tax rates are gradually phased out.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Important note on the salary paycheck calculator. For example if an employee earns 1500.

It will be updated with 2023 tax year data as soon the data is available from the IRS. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. See your tax refund estimate. Sage Income Tax Calculator.

Ad No more forgotten entries inaccurate payroll or broken hearts. The payroll tax rate reverted to 545 on 1 July 2022. UK PAYE Tax Calculator 2022 2023.

![]()

Canada Income Tax Calculator 2022 With Tax Brackets Investomatica

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Loans For Poor Credit

Manitoba Income Tax Calculator Wowa Ca

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

South Africa Tax Calculator 2022 2023 Calculate Your Tax For Free Youtube

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

H R Block Tax Calculator Services

Tax Calculator Estimate Your Income Tax For 2022 Free

Simple Tax Calculator For 2022 Cloudtax

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

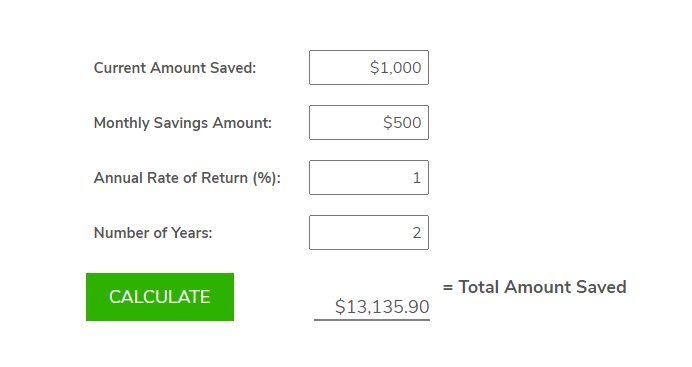

Free Simple Savings Calculator Investinganswers

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

2021 2022 Income Tax Calculator Canada Wowa Ca

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube